Celebrate Safely This Holiday Season: A Message from Mannis Law

The holidays in Chicagoland are full of joy—office parties, family gatherings, and midnight toasts that make great memories. At Mannis Law, we love this season too. We also know that one risky...

Read more

Make Safe and Joyous Holiday Gift Choices This December

The holidays in Chicagoland are all about joy, surprises, and big smiles—especially from the kids. December is also Safe Toys and Gifts Month, a reminder that the best gifts are both fun and safe....

Read more

Thanksgiving Travel Safety Tips for Illinois Drivers

As Thanksgiving approaches, millions of Americans hit the road to share a meal with family and friends—most of them by car. With heavier traffic, unpredictable Midwestern weather, and increased...

Read more

Top Causes of Pedestrian Accidents in Downtown Chicago

Downtown Chicago is one of the city’s busiest walking environments—The Loop, River North, and Streeterville see enormous foot traffic around CTA stations, offices, hotels, and entertainment venues....

Read more

How Long Do You Have to File a Personal Injury Lawsuit in Illinois?

How Long Do You Have to File a Personal Injury Lawsuit in Illinois? It's complicated!If you’re hurt in Chicago or anywhere in Illinois, the clock starts ticking fast. Below is a plain-English...

Read more

A Chicago Halloween: Thrills, Chills, and Staying Safe

Halloween in Chicago is a time for mystery, delight, and just the right amount of fright. From trick-or-treating in historic neighborhoods to festive parties in the city, the night is filled with...

Read more

What Happens If You’re Injured in a Rideshare Accident in Chicago?

Uber and Lyft have transformed the way Chicagoans travel — especially in the downtown area where parking is scarce. But with the increase in rideshare usage comes an increase in rideshare-related...

Read more

Top Causes of Pedestrian Accidents in Downtown Chicago

Downtown Chicago is one of the busiest urban areas in the country. From the Loop to Michigan Avenue, thousands of pedestrians cross streets every hour, sharing space with cars, buses, taxis, bikes,...

Read more

Child Passenger Safety Week: Keeping Chicago’s Littlest Passengers Safe

Life in Chicago moves fast — from navigating the Loop to weekend getaways across Illinois — and it’s easy to overlook critical safety measures when you’re on the go. Child Passenger Safety Week,...

Read more

Embrace Chicago’s Autumn Beauty — But Stay Aware of Slip and Fall Risks

Ah, autumn in Chicago! The leaves transform into brilliant shades of amber and gold, the crisp air signals sweater weather, and the city’s parks and neighborhoods are alive with seasonal charm. But...

Read more

How Long Do You Have to File a Personal Injury Lawsuit in Illinois?

If you’ve been injured due to someone else’s negligence in Illinois, you need to act quickly. The law places a strict statute of limitations on personal injury claims — and missing the deadline...

Read more

What to Expect During a Free Consultation with a Chicago Injury Attorney

If you’ve been injured in an accident, you may be wondering:“Is it worth calling a lawyer? What happens during a free consultation?”At Mannis Law, we understand reaching out to a personal injury...

Read more

Traffic Safety: Your Back-to-School Guide

As summer winds down and August arrives, families across the country transition back to school routines. This time of year is a blend of excitement and, if we’re honest, a little stress as we...

Read more

How Tort Reform is Shaping Medical Malpractice Cases

Understanding the Shift in Medical Malpractice Landscape The landscape of medical malpractice has been undergoing considerable change due to tort reform, sparking concern among both victims and...

Read more

Understanding Jurisdiction: A Legal Foundation

Why Jurisdiction MattersJurisdiction is a cornerstone concept in the legal system, establishing a court's authority to hear and decide cases. This principle is critical in both civil and criminal...

Read more

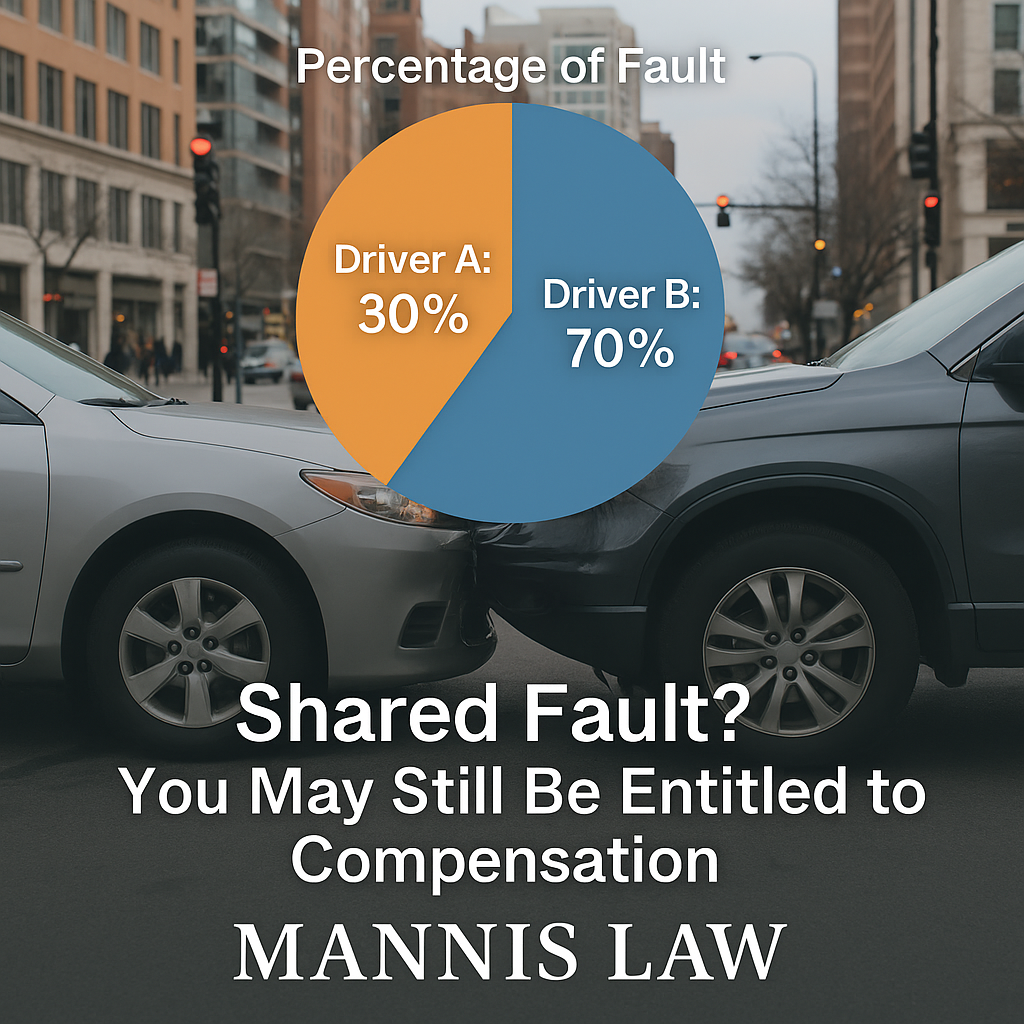

Understanding Comparative Negligence in Illinois Personal Injury Cases

When you're injured in an accident, it's common to wonder:“What if I was partly at fault? Can I still get compensation?”The answer in Illinois is yes—thanks to comparative negligence laws. At...

Read more

Common Mistakes to Avoid After a Slip and Fall Injury

Slip and fall injuries are more than just embarrassing—they can lead to serious, life-changing injuries. If you’ve been hurt on someone else’s property in Chicago, taking the wrong steps after a...

Read more

Celebrate July 4th Safely: Tips for a Fun Holiday

Embrace Independence Day ExcitementIndependence Day is a time of joy and patriotism, marked by vibrant fireworks, lively barbecues, and family adventures. While the holiday is filled with fun,...

Read more

How Much Is My Personal Injury Case Worth?

If you’ve been injured in an accident in Illinois, one of the first questions you may have is:“How much is my personal injury case worth?”While no two cases are alike, there are several factors...

Read more

Preventing Slip and Fall Accidents at Pools

With summer in full swing, swimming pools become a favorite escape for families and friends seeking relief from the heat. Whether you're planning a day at the local public pool or hosting a...

Read more

🚗 What to Do After a Car Accident in Chicago: A Step-by-Step Legal Guide

Being in a car accident is overwhelming—especially in a busy city like Chicago. Whether it's a fender-bender on Lake Shore Drive or a multi-vehicle crash on I-90, knowing what steps to take...

Read more

Fireworks Fun & Safety: Tips for a Safe Celebration

Embrace the Sparkle: Enjoy Fireworks SafelyThere's something magical about fireworks lighting up the summer sky during celebrations, adding sparkle and excitement to any gathering. As we approach...

Read more

Understanding Slip-and-Fall Claims: Key Insights

Slip-and-fall accidents happen more often than many realize, and their impact can be both physically and financially devastating. Understanding the legal landscape surrounding these cases is...

Read more

Bicycle Accidents: How Cyclists Can Protect Themselves Legally

As more people embrace cycling for health, environmental, or commuting reasons, ensuring that cyclists are protected in the event of an accident is increasingly important. Here are some key steps...

Read more

Navigating Insurance Claims in Personal Injury Cases

Dealing with insurance companies after a personal injury can be overwhelming, but understanding the process can make a significant difference. While it's possible to handle a claim on your own, it...

Read more

Enhance Your Ride: Bicycle and Motorcycle Safety Tips

May is Bicycle and Motorcycle Safety Awareness Month—a time to refresh our road safety habits and help prevent accidents. For both cyclists and motorcyclists, acknowledging the unique risks they...

Read more

Understanding Your Rights After an Auto Accident in Chicago

Being involved in an auto accident can be a daunting experience, especially in a bustling city like Chicago. Knowing your rights in such situations is crucial, as it can significantly affect the...

Read more

Do You Need a Lawyer for a Minor Car Accident in Illinois?

When you find yourself in the unfortunate spot of a minor car accident in Illinois, the immediate question that often arises is, 'Do I need a lawyer?' Many assume that minor accidents, which...

Read more

Understanding the Three Types of Personal Injury Damages

Understanding personal injury damages is critical for anyone navigating a claim. These damages can provide much-needed financial support and justice for individuals who have been wrongfully injured...

Read more

Distracted Driving: Awareness and Legal Insights

April's Pledge: Ending Distracted DrivingEach year, Distracted Driving Awareness Month serves as a critical reminder of the life-altering consequences caused by a split-second of inattention behind...

Read more

Spring Break Travel: Stay Safe and Know Your Rights

Spring break is just around the corner, bringing with it the promise of unforgettable road trips, sun-soaked beach vacations, and thrilling adventures. This season is all about unwinding and having...

Read more

What Insurance Companies Don’t Tell You About Personal Injury Claims

In the complex world of personal injury claims, understanding how insurance companies operate can be both enlightening and empowering. When you’re injured, and it isn’t your fault, dealing with...

Read more

Navigating Social Media During Injury Cases

In today's world, sharing our lives on social media is second nature. However, if you're involved in a personal injury case, it's crucial to understand how your online activities can impact your...

Read more

Slip and Fall Cases: Legal Essentials and Next Steps

Slip-and-fall accidents happen more often than many realize, and their impact can be both physically and financially devastating. Understanding the legal landscape surrounding these cases is...

Read more

What to Do If You Get Hurt: A Personal Injury Guide

Being injured can be a daunting and unsettling experience, leaving you feeling stressed and confused about what comes next. It's crucial to remain calm and take appropriate action early to protect...

Read more

Your Rights as a Rideshare Passenger in an Accident: What You Need to Know

With the rise of rideshare services like Uber and Lyft, more people are opting for the convenience they provide. However, the increasing number of rideshare users also brings a higher chance of...

Read more

Injured as a Passenger in an Uber or Lyft? Here’s What You Need to Know About Your Rights

As a passenger in an Uber or Lyft, you have rights and protections if you suffer an injury during a ride. These rideshare companies offer significant convenience, but accidents can happen....

Read more

Fire Trucks Outside My Apt Today!

The sirens could be heard from blocks away, and then about ten fire trucks, ambulances, and a hook and ladder truck came down my street and stopped, the firemen jumping out of their trucks,...

Read more

Tough Call On Not Enough UM Insurance

My client called me a couple of months ago with bad news. She had been rear-ended by an uninsured driver. I told her that somewhere around 20% of all drivers on the road in Illinois are driving...

Read more

I Was Injured By An Uninsured Driver. What Can I Do About It?

In Illinois, when YOU have insurance, you are protecting yourself against the possibility that you’ll be hit and hurt by someone without insurance. That part of YOUR policy is called the Uninsured...

Read more

Changes To Insurance Limits In Illinois For 2021? – Spoiler…. There Are None.

No changes in Illinois minimum coverage for 2021! That’s the headline and the bad news. Auto insurance is required for every vehicle in Illinois, and the state requires minimum coverage of $25,000...

Read more

I’ve Been Hurt In A Crash. Should I Wait To See A Doctor?

If you are hurt in a crash, it is crucial that you seek medical attention as soon as possible. First of all, assessing your injuries and getting the treatment you need is what’s best for you. This...

Read more

What’s The Effect Of Covid Pandemic On Court And UM Claims?

The Covid pandemic has ravaged society, with effects on every level of everyday life. It has also affected court cases and uninsured motorist cases, though in different ways. For the most part,...

Read more

Can I Handle An Uninsured Motorist Injury Claim Myself?

The quick answer is sure you can. Your insurance policy has provisions that deal with the possibility that you or a family member driving your car will be hit by a driver with no insurance, or not...

Read more

I’m Hurt And I Don’t Have Medical Insurance!

Medical insurance isn’t so streamlined in America. The latest statistics reveal that, even after the creation of the Affordable Care Act, there are millions and millions of people without health...

Read more

Do I Have Enough Auto Insurance?

How much insurance do you really need? Well, the short answer is “the more, the better,” but it gets expensive, right? That said, my strong advice is that you need AT LEAST coverage of 100/300 to...

Read more

Higher UM Limits For Illinois

Several years ago, the State of Illinois amended their statutes regarding minimum limits on automobile liability coverage. The minimum limit was raised from 20/40 to 25/50. Along with that raise in...

Read more

Your Uninsured Motorist Coverage Protects You On Your Bike

I recently settled a claim for a client who had been badly hurt when she was struck by a car while riding her bike. She was thrown to the sidewalk, landing on her shoulder and head, then spent...

Read more

Protecting Subro Rights When Filing For Underinsured Motorist (UIM) Claim

A requirement under most Illinois insurance policies is that the possible subrogation rights of the UIM carrier must be protected, or waived by that carrier, before making a settlement on the...

Read more